TL;DR: You need disability insurance as a resident, and we have access to a high quality and discounted policy listed below.

What is Disability Insurance? Why is it important? Do we need to get it during residency? Where do we buy it? Disability insurance (DI) is one of the more complicated insurances you’ll need to purchase during your life. This introduction will give you an overview of DI, links to additional reading, and information about a high quality insurance plan to which we have discounted access as UW interns, residents, and fellows.

Disability insurance protects against loss of future income in the event that you become fully or partially disabled. There are multiple reasons to obtain a strong DI policy sooner rather than later in your career. The cost of premiums for a given policy will increase as you age, so purchasing earlier, thus locking in your age, can save money in the long run. There is no way to know if or when disability may happen, and DI only works if in place prior to a disability occuring. Furthermore, even medical conditions not currently limiting function can hinder one’s ability to get full DI coverage. It is best to apply early, and secure coverage when one is as healthy, and as young, as possible.

One of the most important aspects of any disability insurance policy is the language of the contract. It needs both a strong definition of disability, and coverage of a broad range of possible disabilities. “Specialty specific own occupation” is imperative for physicians. This means that if you are not able to work to full capacity in your specific field of training, you are still entitled to receive disability benefits even if you are able to work in a different specialty or occupation. For example, if an anesthesiologist becomes disabled such that they are no longer able to practice in the OR, however is able to retrain and work as an internist, they would still receive disability benefits for not being able to make an anesthesiologist income.

Not all insurance companies offer policies with this critical “specialty specific own occupation” language, and it is important to work with an insurance advisor who has significant experience with DI, as well as one who understands the unique complexities of the medical field for physicians.

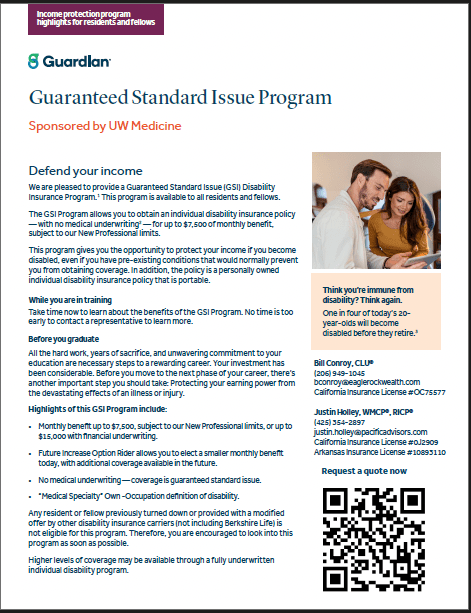

We want to make sure everyone is aware of a high-quality insurance plan we have access to as UW interns, residents and fellows.

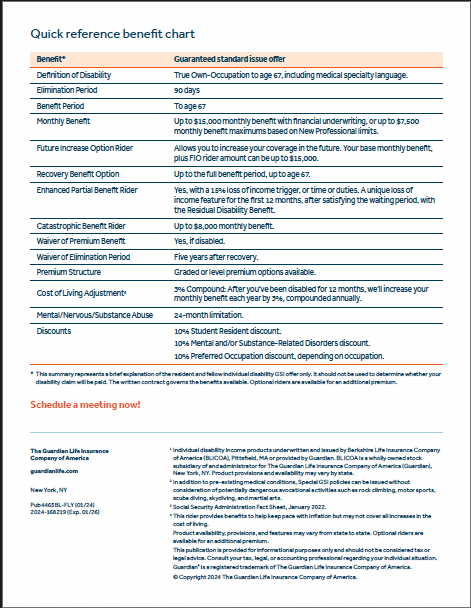

- This is a Guaranteed Standard Issue (GSI) plan through Guardian, which means that there is no medical history questionnaire or medical exam required for the application. Coverage is guaranteed, unless you have previously been declined DI coverage by another carrier.

- In addition to being a simplified application with guaranteed approval, we receive a discount up to 30% off standard rates.

- This Guardian plan has the important specialty specific own occupation language, and a strong, broad definition of disability.

- As trainees, we can purchase plans that would pay monthly benefits of up to $7500 (depending on salary and specialty), and this policy payout can be increased over time (as salary increases) to up to $15,000/month.

- Enhanced partial disability rider

- There is a cost-of-living-adjustment (COLA) rider

- Student loan payment protection rider

- Benefits which will pay up to age 67

- Payments for the policy can be set up on a graded or level plan, to help find a budget that works for you.

If you are shopping around for different plans, make sure to look into this GSI plan before going through medical underwriting with any other company, as it could void this GSI offer for you. Don’t risk it.

There are two trusted advisors you can reach out regarding this plan:

Bill Conroy 206.949.1045. bconroy@eaglerockwealth.com

Justin Holley 425.985.0182 justin.holley@pacificadvisors.com

We hope this overview helps you navigate the unintuitive landscape of disability insurance. To read more about the specifics of disability insurance, which riders/components are important, and a list of other reputable, independent disability insurance agents, check out the links below:

- https://www.whitecoatinvestor.com/what-you-need-to-know-about-disability-insurance/ (some of our board members have had positive experiences working with Larry Keller, one of the recommended independent agents)

- https://www.physicianonfire.com/disability-insurance-mistakes-2/

- https://www.physicianonfire.com/physician-disability-insurance/